| Author | Affiliation | GitHub |

|---|---|---|

| N.F. Katzke. | Satrix Investments | https://github.com/nicktz |

Relevant News / Topics

2023 News Links

2022 News Links

2021 News Links

Active Passive in the spotlight again

The last while, there’s again been quite a lot written about the active - passive debate. See recent funds on Friday articles here, Finweek article by Johan Fourie here.

Gareth Stobie, I thought, summarised it nicely here, that “Believe it or not, passive zealots frustrate many passive asset managers too. This is because advisers and clients don’t want an argument – they want solutions that help them navigate the complex, jargon-heavy world of investing. It doesn’t help the savings and investment industry to position the active-versus-passive debate in such a binary fashion.”

Both active and passive have a role to play - the former in price discovery and shaping efficiency, the latter in providing cost effective and diversified alternatives to supplement one’s portfolio. It should not be framed as either-or, but rather how to sensibly combine indexed, long-term structures with managers able to provide additional upside potential (and hopefully even downside mitigation).

Fund capacity - can a fund become too large?

JSE NPN/PRX Capping methodology proposal

Balance Sheets or Trends?

JSE to propose a benchmark for Multi-asset funds?

Is this feasible though? Particularly, as asset allocation remains an active decision, whether you track or not. Will be interesting to see what their Strategic Asset Allocations (SAA)’s will be, how they’ll defend this decision and whether they change them from time to time.

What’s the alternative though? Peer group? CPI? Both are flawed, sure, but how else?

Naspers and Prosus Share Swap next week

Old but good - how NPN acquired a stake in Tencent for Peanuts

2020 News Links

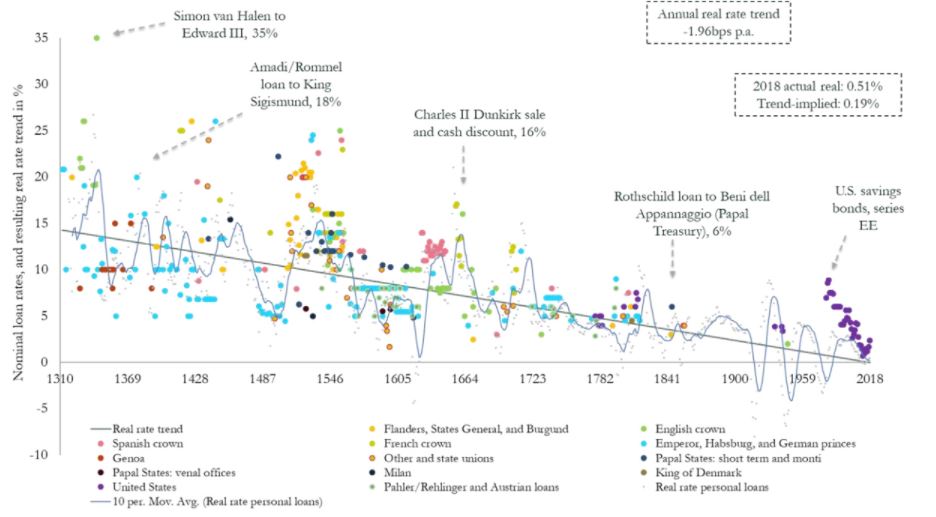

Interest rates the last 700 years visualized.

See more on this fascinating plot here

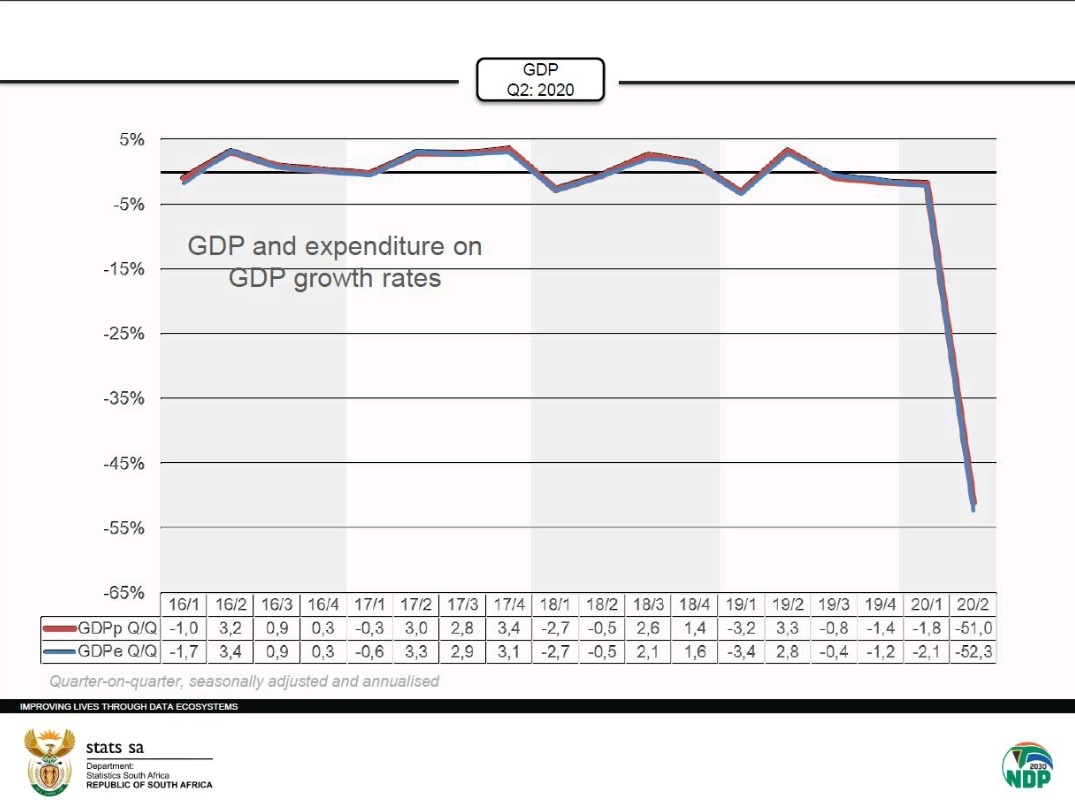

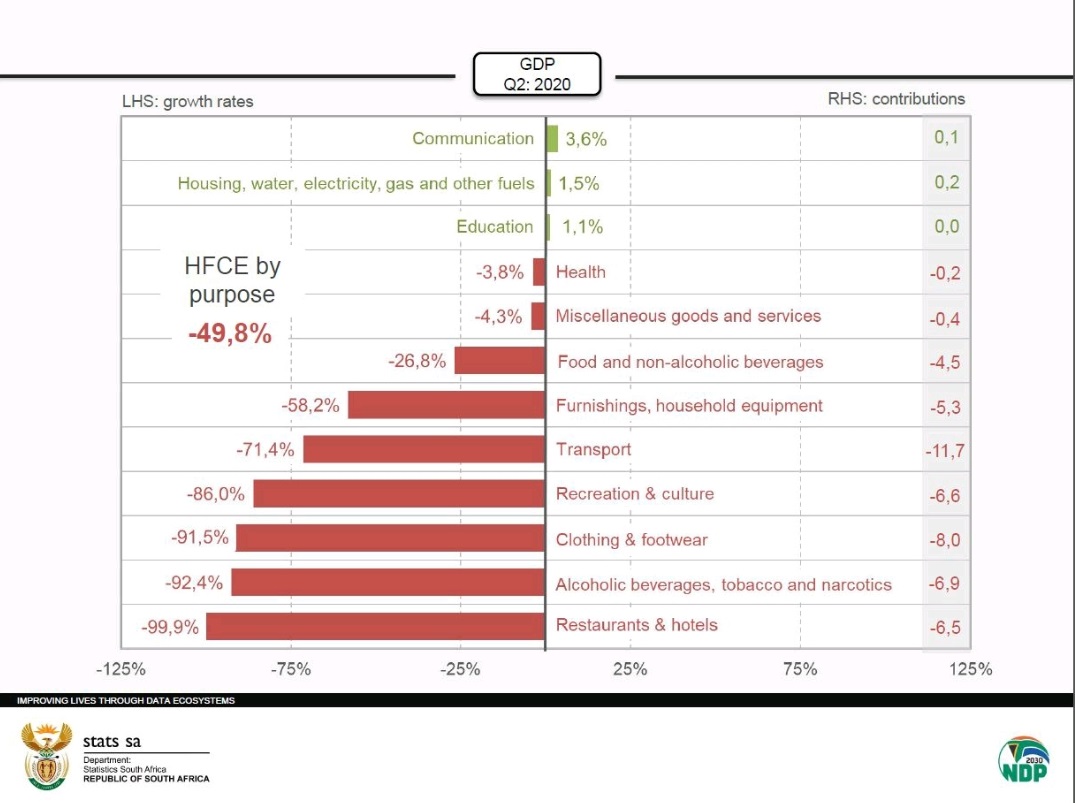

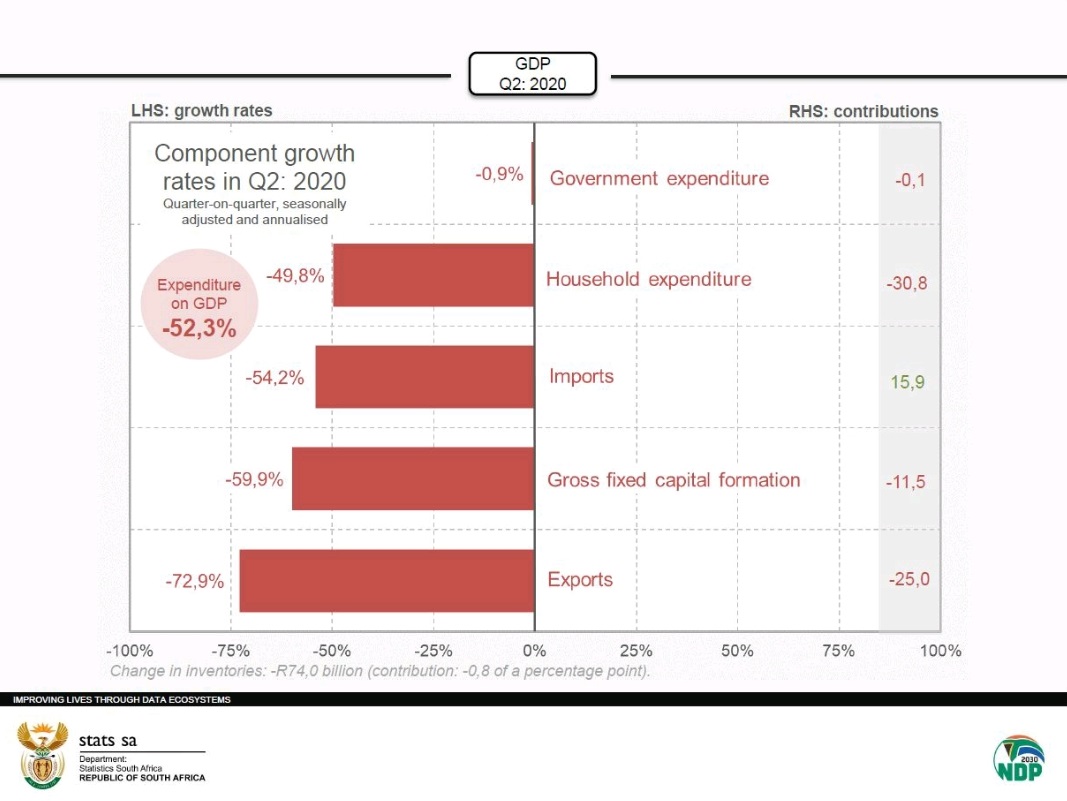

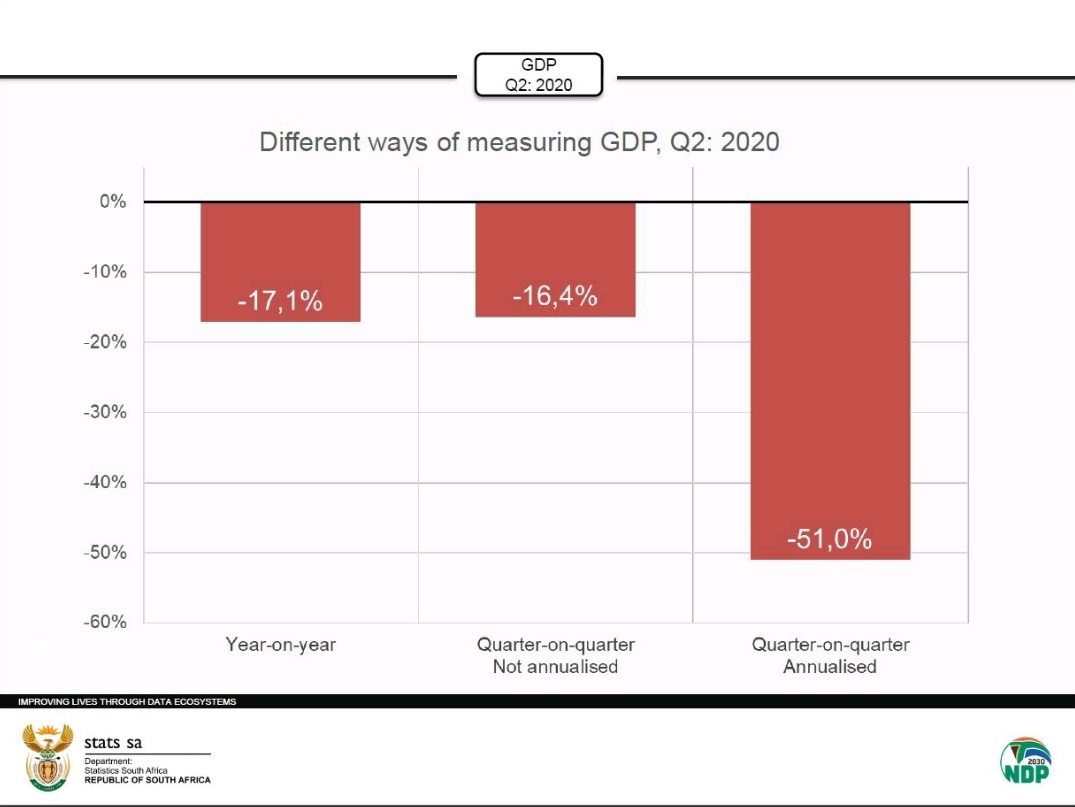

Economy halved? …

In short - be wary of annualized numbers in life…

Yes, while the GDP numbers for Q2 look terrible (and they are) - by annualizing the numbers it really looks depressing.

But it is somewhat misleading, as annualized numbers in this case would mean GDP halving if all the remaining quarters saw similar contractions.

In fact, output decreased by ~16% in Q2. Bad, but not 50% bad (see what annualized numbers did there?)

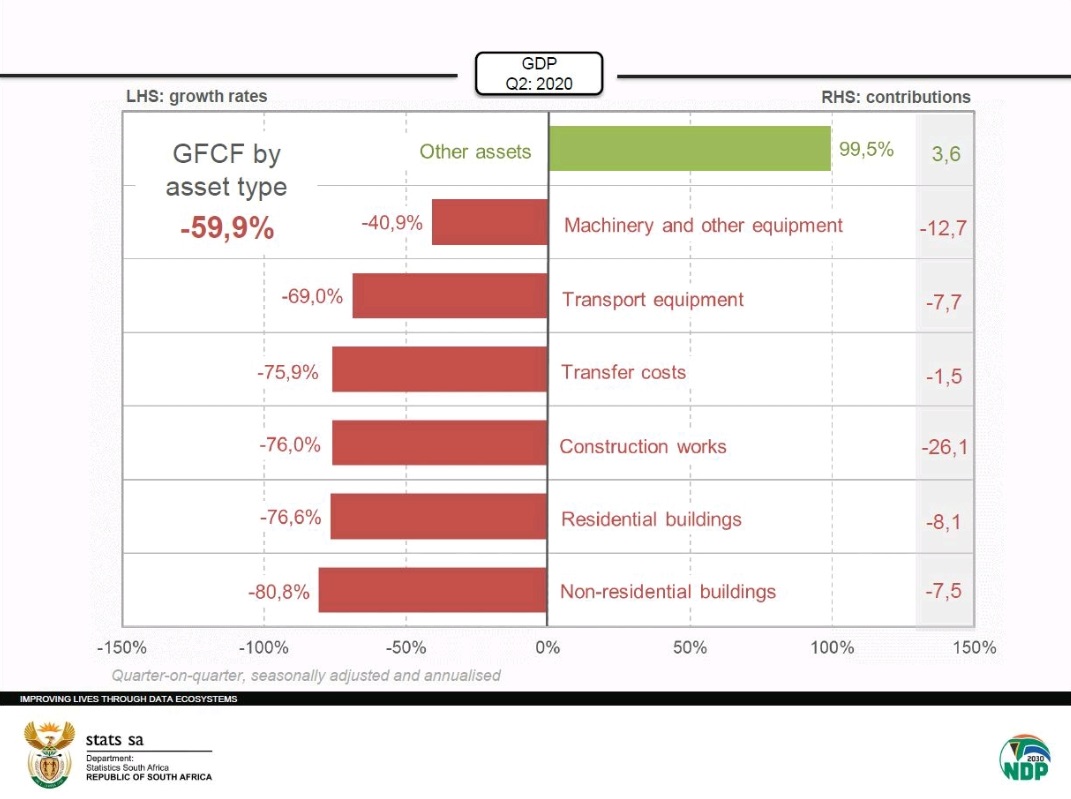

Some figures from treasury underscores the Covid impact on SA… It’s been tough!

- Softbank (tainted financier bank of WeWork) again not showering itself in glory (labelled as the Nasdaq Whale):

Where to put your assets: 3 - 10 years. You agree with the money managers?

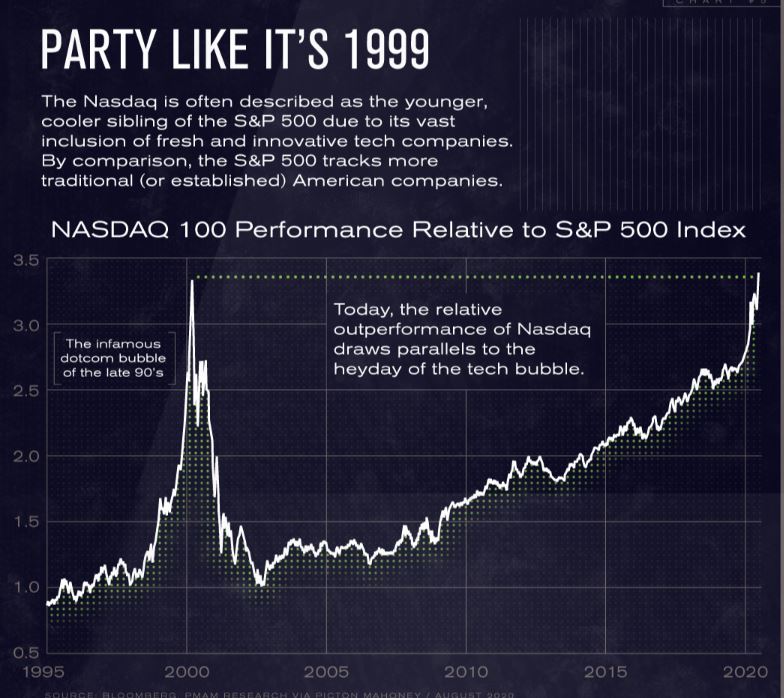

Stock markets a bit “frothy” at present? See this article for an interesting perspective.

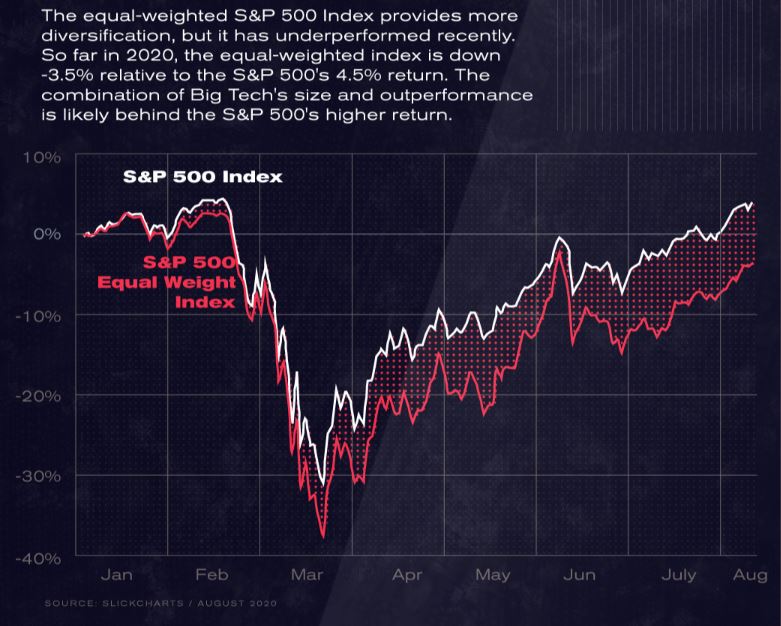

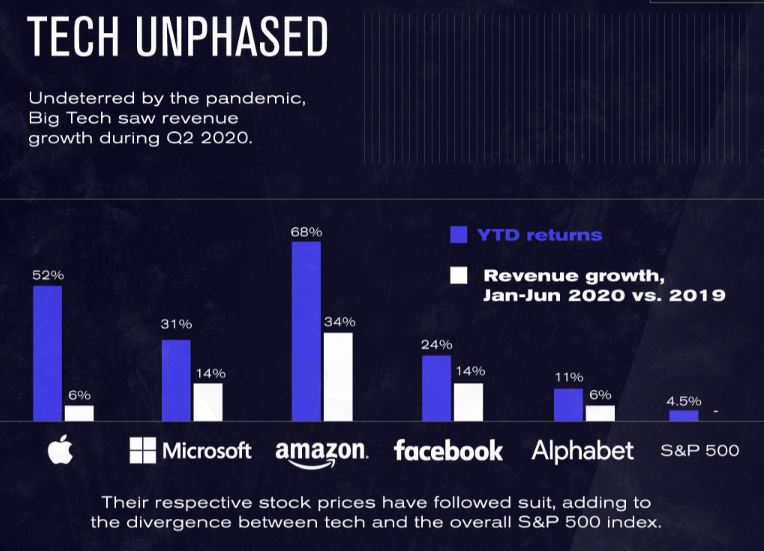

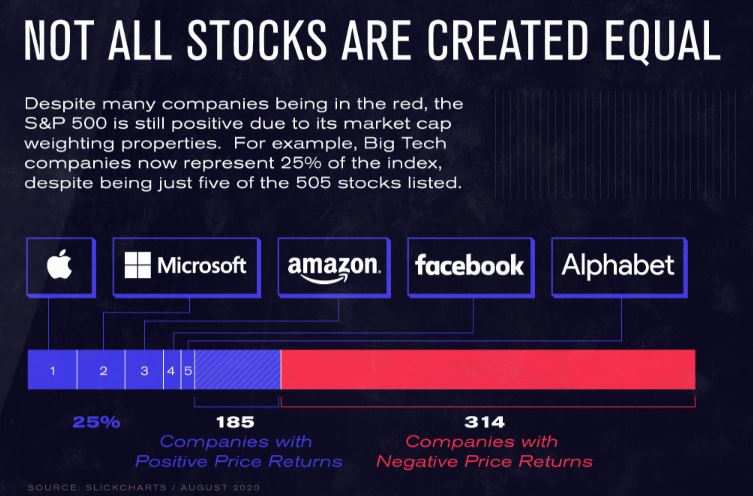

What’s driving the SP500 surge?

Read this short article on the runaway SP500

See these interesting figures

See here for more.

Relevant News / Topics - Last Year that’s still worth reading

Tech IPOs

This year saw many tech companies offer IPOs to let new investors partake in their meteoric rise ; cynics might say rather they are (at times) attempting a smash-and-grab by taking advantage of lofty valuations and market hubris on tech…

However, some tech analysts call the IPO market for tech companies broken (lamenting IPO price setting that is too low) - but the reality is that IPOs are very much needed for early insiders and investors to cash out. Much of these companies also drastically require capital (e.g. WeWork) - to keep their dreams of success alive. So even though intermediary institutions that set the IPO price might do so at lower levels than the insiders would be happy with (of course, they would like $∞).

Slack (and last year Spotify) defied the typical IPO route by doing a direct listing, or DPO - whereby no new shares are issued, but simply existing shares are sold on the market (no underwriters / third parties involved). These shares are mostly those held by early investors - giving them the ability to sell off their holdings without the cost and price setting of an intermediary.

- WeWork IPO

WeWork’s IPO in-the-works a real disaster

- Uber IPO

With Uber’s IPO price set at $45 (see here for details just before the IPO), early investors have lost quite a bit.

Currently, Uber trades at $34, down 25% from its IPO.

- Lyft IPO

Fed cuts rates

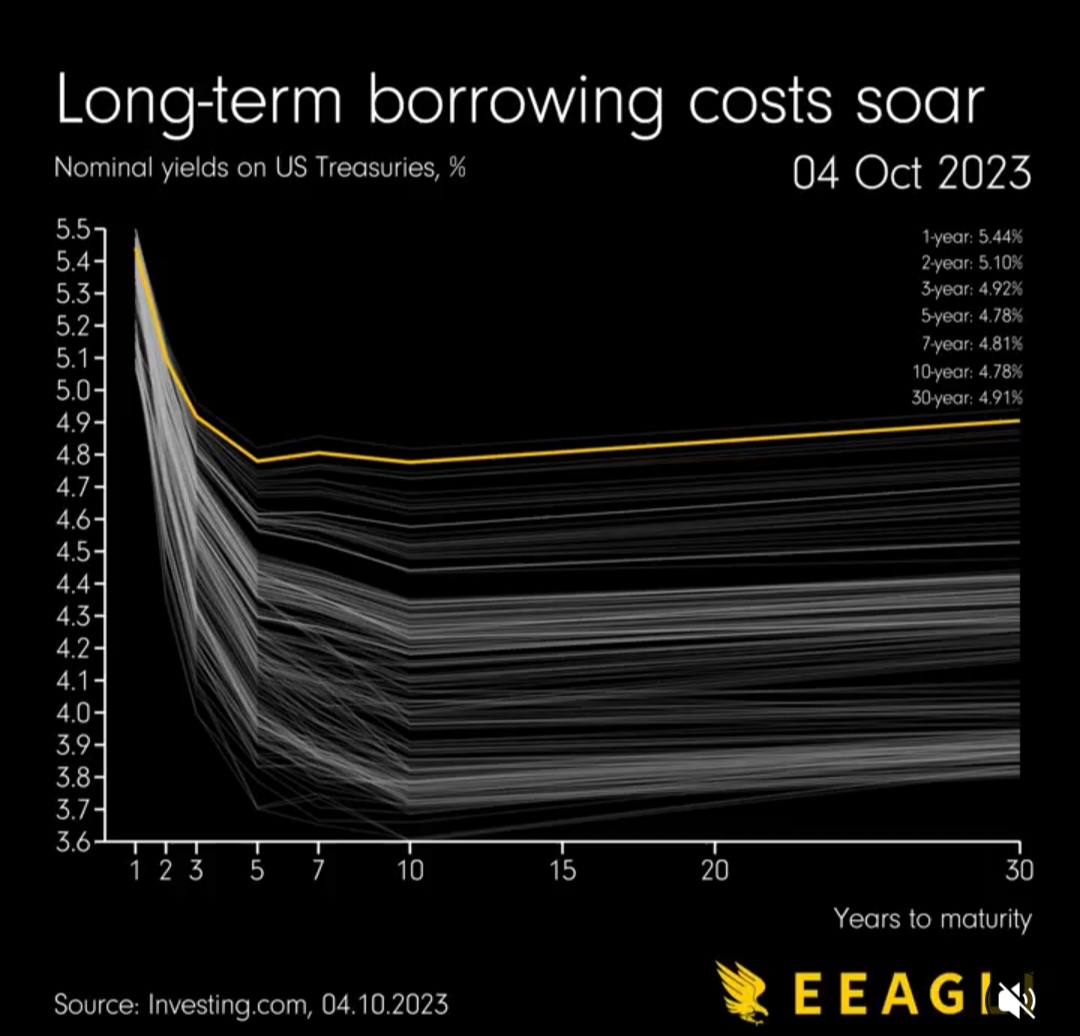

Inverted Yield Curve

- See this great FT summary:

Despite economic data not suggesting a recession is imminent… An inverted yield curve is a warning sign precisely because it tells investors about expectations for the future and not necessarily about the state of things right now. There are concerns that the economic sugar rush provided by tax cuts last year are wearing off, while there is little sign of trade tensions abating. But while possible, a looming recession in the next 24 months is not ensured by the inverted YC.

- See this great simple summary